Active Member FAQs

Frequently Asked Questions for Active Firefighters

Whether you are a paid or volunteer firefighter, these FAQs can help you successfully plan for retirement. If you have any questions not covered here or need additional information on any of the topics below, please contact us.

Paid Firefighters

What is the procedure for enrolling a new paid firefighter in the System?

- The applicant must successfully pass a State Board-approved performance/agility test.

- The applicant must successfully pass a physical examination as promulgated by the rules of the State Board.

- The participating municipality must forward the results of the performance/agility test and physical examination along with an application for entrance form (Form 13) to the System.

- When all the information is received, the Executive Director will deny or approve the application and, if approved, will establish a hire date as of the date the information is received or the actual hire date, whichever is later.

(Note: If an applicant is an active volunteer firefighter and has successfully passed a State Board-approved performance/agility test in the same department and is applying for a paid position in that same department, an additional performance/agility test will not be required.)

What is the difference between a performance/agility test and a physical examination?

A performance/agility test demonstrates the ability to perform actual or simulated job-related tasks and is not a medical examination. The performance/agility test is used to determine if an applicant can perform job functions and, therefore, is administered at the pre-offer stage of initial employment. Employers may also ask at the pre-offer stage of employment about the applicant’s ability to perform a specific job function unrelated to the applicant’s medical condition.

The employment physical examination is administered after a conditional offer of employment is made. It is used to determine if the applicant meets the minimum medical standards of the System, to establish pre-existing medical conditions, and to determine if reasonable accommodations can be made in order for the applicant to perform the required job functions.

What are the ADA hiring considerations regarding membership in the System?

The provisions of the ADA concerning medical examinations and disability-related injuries reflect the intent of Congress to prevent discrimination against individuals with “hidden” disabilities such as epilepsy, diabetes, mental illnesses, heart disease, HIV infections, or AIDS and cancer. The guiding principle of these provisions is that while employers may ask applicants about their ability to perform job functions, they may not ask about disabilities at the pre-offer stage of employment.

ADA will not allow any questions about a disability under the law, and employers may not inquire about the existence, nature, or severity of a disability during the pre-offer stage of employment. Further, an employer may not conduct medical examinations until a determination is made that the applicant is qualified for the job and a conditional offer of employment is made. This prohibition is to ensure that an applicant’s possible hidden disability, including a prior history of a disability, is not considered by the employer prior to the assessment of the applicant’s non-medical qualification.

What assistance does the State Board provide fire departments regarding ADA compliance?

The State Board has adopted rules to conform to the ADA. A job description for entry-level personnel has been adopted by the State Board and should be adopted by your department. Volunteer fire departments are not subject to the physical examination requirements of the System; however, some volunteer departments are administering performance/agility tests and physical examinations.

Paid firefighters are required by law to be administered performance/agility tests and physical examinations. The state board will allow a participating municipality to develop its own performance/agility test if it meets the minimum requirements of the state board-adopted performance/agility test. The State Board must approve the participating municipality’s performance/agility test before it can be administered. The performance/agility test is of paramount importance and must relate to the job description so as not to violate the ADA. The performance/agility test must be generic in nature and must not require fire ground functions that would require training to pass the test. The performance/agility test should be such that an untrained applicant could reasonably be expected to complete it in a satisfactory manner. The performance/agility test must be given before a position as a paid firefighter can be offered.

What are the specific forms and procedures provided by the State Board to assist in ADA compliance?

A Form 9 is used to administer the minimum performance/agility test. A Form 10 is the waiver and release form for the applicant to sign. On the back of the Form 10 is an optional Personal Physician’s Release of the applicant. The Applicant Waiver and Release and Personal Physician’s Release are of paramount importance. Remember, you are asking an applicant to take a performance/agility test without even taking vital signs or asking questions concerning the applicant’s medical history.

It is strongly recommended that the applicant is provided a copy of the job description, performance/agility test, and release forms upon making an application. The required tests should be explained to the applicant so that the applicant can physically prepare for the test. The applicant should also be advised that the tests are physically demanding and require some physical preparation, which will allow the applicant to make a decision as to their physical ability to successfully complete the required tests. Two (2) witnesses should sign the completed performance/agility test. One witness should be the person administering the test, and the other witness a person who observed the test.

Upon successful completion of the performance/agility test, you can then conditionally offer the applicant a firefighter position. The applicant is now ready for the physical examination. A physician shall conduct the examination and provide the participating municipality with the results on the Physical Exam and Laboratory Assessment Form (Form 14). The participating municipality will then forward, to the State Board, copies of the completed physical examination (Form 14), performance/agility test (Form 9), and an Entrance Application Form (Form 13), including the hire date and signed by the Fire Chief and the applicant. The testing procedure will take some planning to allow the application to be processed in a timely manner. The state office, if requested, will assist you in the process.

Must a paid firefighter complete another physical examination after terminating from one participating municipality and going to work for another participating municipality as a paid firefighter?

- If the firefighter goes to work within six (6) months of termination the firefighter would not be required to complete another physical examination.

- If a firefighter transfers to your participating municipality from another participating municipality, notify the state office immediately by sending a new completed Entrance Application Form (Form 13). This will allow the System to update the records so that contributions can be accepted.

Contributions-Paid Firefighters

What is the procedure for reporting paid firefighter and employer contributions?

- Report after every payroll – no later than ten (10) days after the pay period ending date. IMPORTANT: IF CONTRIBUTIONS ARE NOT RECEIVED IN OUR OFFICE WITHIN THIRTY (30) DAYS FROM THE PAY PERIOD ENDING DATE, A ONE AND ONE-HALF PERCENT (1.5%) PER MONTH CHARGE WILL BE ADDED.

- Use the pre-list (list shows each active firefighter), which is mailed from the state office.

- Return the pre-list showing the pay period ending date and total contributions paid, along with a check for both the employer and employee’s share of contributions to the Oklahoma Firefighters Pension & Retirement System.

What is a pre-list, and where is it obtained?

- A pre-list is a computerized statement of your last payroll report. It lists all current active paid firefighters, social security numbers, gross salary, and contributions reported.

- A pre-list will be mailed to you from the System after your last payroll report has been processed. If you should not receive your pre-list, you may use a copy of the previous month’s report.

How do I fill out the pre-list?

- Put the pay period ending date in the upper right-hand corner and include month, day, and year.

- Check social security numbers and spelling of firefighter names.

- Line through all terminated firefighters and list the termination date and reason for termination.

- Write in all new firefighters, making sure social security numbers and spelling of names are correct. DO NOT send contributions on any firefighter who has not been approved for entrance by the Executive Director.

- Total gross receipts and employee and employer contribution columns at the bottom of the page.

- Employer contribution share shall be fourteen percent (14%) of total gross salary and employee’s contribution shall be nine percent (9%) of total gross salary.

- Make your check payable to the Oklahoma Firefighters Pension & Retirement System and mail the pre-list and check(s) to the state office.

- It will be helpful if you keep a copy of the pre-list you send the System to verify your contributions at the end of the year with the amount the System has shown for you and your employees.

- State statute establishes paid firefighter contributions. Currently, the contribution amount for paid firefighters is nine percent (9%) of total gross salary paid each month, and employer contributions are fourteen percent (14%) of total gross salary paid to the firefighter each month.

- Firefighter contributions shall be deducted from the total gross salary prior to federal and state tax withholdings.

Which payroll items are included as a part of total gross salary?

Examples of items included as part of total gross salary are: base pay, longevity pay, EMT pay, EMT-Paramedic pay, scuba pay, lead man pay, out-of-class pay, education pay, red book pay, one-time bonus pay, fitness pay, and FLSA scheduled overtime pay. In addition, sick and vacation leave buy back pay when done on an annual basis and if available to all firefighters.

Examples of items which are not part of total gross salary are: clothing allowance, car expense, unscheduled overtime, reimbursement for out-of-pocket expenses, and vacation and sick leave buy back paid upon termination of retirement.

IF THERE ARE QUESTIONS ON ANY PAYROLL ITEMS TO BE INCLUDED AS PART OF TOTAL GROSS SALARY, CONTACT THE SYSTEM FOR ASSISTANCE.

What if a paid firefighter terminates employment and requests a refund of contributions?

- Refund of Contribution Application (Form 12) must be submitted to the System.

- Refunds will not be paid until sixty (60) days after termination to ensure that all contributions paid by the firefighter are received by the System. Contributions paid by the member beginning January 1, 1989, have not had taxes withheld. Unless a member wishes to rollover these moneys, to a qualified plan, the System is required to withhold twenty percent (20%) for federal income taxes.

- Complete a Notification of Termination from the Fire Department (Form 8) when a member terminates from your department.

- If the firefighter has served ten (10) or more years, the member may wish to elect a vested benefit rather than a refund of contributions.

The following must be submitted to the state office:

- Notice of Termination from the Fire Department (Form 8) must be submitted by the participating municipality when the firefighter leaves.

- Application for Entrance (Form 13) must be submitted by the participating municipality the firefighter is joining.

What if a paid firefighter terminates employment with a participating municipality, receives a refund of contributions, and then returns to work for another or the previous participating municipality?

Provided the firefighter is not over forty-five (45) years of age and pursuant to O.S. 11 ’49-117.1, in order for the previous service credit to count towards a normal retirement date, all contributions must be paid back to the System plus ten percent (10%) annual interest.

Retirement for a Paid Firefighter

What if a paid firefighter wishes to retire after twenty (20) years of service?

The following information must be submitted to the System:

A. Application for Retirement (Form 1)

B. Minutes from the local board where the local board exists.

C. Request for Federal and State Income Tax Withholding (Form 6)

How is the pension amount determined for a paid firefighter with twenty (20) years of service?

A paid firefighter with twenty (20) years of credited service is entitled to fifty percent (50%) or two and one-half percent (2.5%) of the firefighter’s final average salary. “Final average salary” means the highest thirty (30) consecutive months of the last sixty (60) months of credited service. Total gross salary shall include the items as listed in Example 1 as stated in Question 24 of this handbook.

How is the pension amount determined if a paid firefighter has served more than twenty (20) years?

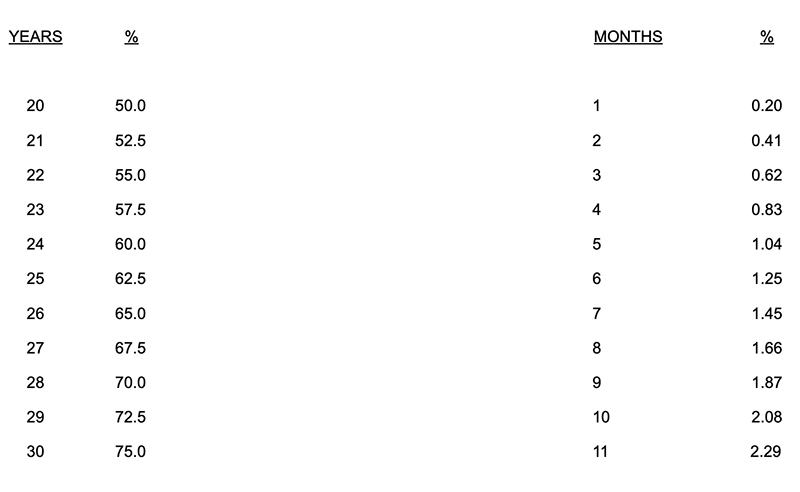

If a paid firefighter serves more than twenty (20) years, an additional two and one-half percent (2.5 %) will be paid for each year of credited service not to exceed thirty (30) years or seventy-five percent (75%). Additional months served will also be included in calculating pensions, with any portion of a month over fifteen (15) days being counted as a full month.

Example:

22 years – 55.00%

9 mos. – 1.87%

16 days – .20%

Total 57.07%

(Firefighter receives 57.07% of final average salary)

Below is a breakdown of percentages by years and months to be used in calculating additional service time over twenty (20) years:

Disability Retirement for a Paid Firefighter

What if a paid firefighter wishes to apply for a disability in line of duty pension?

The following information must be submitted to the System:

- Application for Disability Pension (Form 2)

- Minutes from the local board where the local board exists

- Medical statements from two (2) physicians certifying the nature of the disability and that the firefighter can no longer perform his duties as a firefighter.

- Any proof of injury reports that are available

- Request for Federal and State Income Tax Withholding (Form 6)

How is a disability in line of duty pension calculated for a paid firefighter?

A disability in line of duty pension calculation is one-half (1/2) of the firefighter’s average monthly salary, which was paid to the firefighter during the last thirty (30) months of service. If the applicant has served over twenty (20) years, the pension is calculated the same as a regular service pension.

Who is responsible for the payment of the physician's examinations for disability determination?

All disability applications require two (2) physician’s statements certifying the disability and that the applicant can no longer perform the duties of a firefighter. The applicant or the participating municipality when applying on behalf of the member is responsible for the physician’s statements. If only one physician statement is presented or there is a difference in the opinion of the two (2) physician’s statements, the State Board will be responsible for any additional examinations if needed.

What if a paid firefighter wishes to apply for a disability not in line of duty pension?

The following information must be submitted to the System:

- Application for Disability Pension (Form 2)

- Minutes from the local board where the local board exists

- Two physician’s statements certifying the disability and that the applicant can no longer perform the duties of a firefighter

- Request for Federal and State Income Tax Withholding (Form 6)

How is a disability not in line of duty pension calculated for a paid firefighter?

A disability not in line of duty pension calculation is one-half (1/2) of the average monthly salary which, was paid to the firefighter during the last sixty (60) months of service if the firefighter has less than twenty (20) years of credited service. A firefighter with over twenty (20) years of service may not make an application for a disability not in line of duty pension.

Volunteer Firefighters

What is the size limitation of a volunteer fire department?

Any municipality having a volunteer fire department with less than three (3) paid firefighters shall limit, by ordinance, the number of volunteer firefighters to not less than twelve (12) or more than twenty-five (25) members for municipalities with a population of more than one thousand five hundred (1,500); or not less than eight (8) or more than twenty-five (25) members for municipalities with a population of eight hundred (800) to one thousand five hundred (1500); or not less than six (6) or more than twenty-five (25) members for municipalities with a population of less than eight hundred (800).

Any municipality having a combination fire department with more than two (2) paid firefighters and at least one volunteer firefighter shall not have more than twenty-five (25) volunteer firefighters. However, a combination fire department that had more than twenty-five (25) volunteer firefighters on June 1, 2003, shall be limited in the future to the number of volunteer firefighters enrolled on June 1, 2003.

County Fire Departments shall limit the size of the volunteer fire department to not less than six (6) or more than twenty (20) members per station.

The volunteer limit does not apply to Fire Protection Districts.

How is a volunteer firefighter enrolled as a member in the System, and will a volunteer firefighter have to complete a performance/agility test or a physical examination before entering the System?

- Entrance Application Form (Form 13) must be completed and signed by the applicant and the fire chief and returned to the System as soon as possible. DO NOT WAIT UNTIL A PROBATION PERIOD IS COMPLETED TO SEND THE FORM 13, AS THE FORM 13 IS THE PRIMARY EVIDENCE OF ENTRY INTO THE SYSTEM. To delay submission of the Form 13 can result in a later entry date for the firefighter and could alter the date the member would qualify for retirement benefits.

- When a volunteer is terminated from a department (INCLUDING TERMINATION AT THE END OF A PROBATION PERIOD), notify the System by letter or use the Termination Form (Form 8), giving the firefighter’s social security number, termination date, and reason for termination.

- The State Board does not require a performance/agility test or a physical examination for a volunteer firefighter.

How are volunteer firefighter contributions determined?

State statute establishes volunteer contributions, which are due July 1 of each year. The System will provide a pre-list showing all volunteer firefighters, which will be mailed to each participating municipality sometime in June. Sixty dollars ($60.00) will be due for each volunteer member. Volunteer cities with income of less than twenty-five thousand dollars ($25,000.00) to its General Fund during a fiscal year are exempt from paying contributions. This exemption is based on annual income from the General Fund and not the cash balance at the end of the year. An exemption form is required each year and may be obtained from the System.

What form is used to report volunteer contributions?

The System will mail a Pre-List/Invoice sometime in June of each year.

How do I complete the form for volunteer contributions?

- List any new volunteers that have been added during the year or are not printed on the form. List their name, social security number, and hire date, and complete an Entrance Application Form (Form 13) for each new volunteer added.

- Line through any volunteer who has been terminated, and list the termination date and reason for the termination.

- Return the list, along with a check made payable to the Oklahoma Firefighters Pension and Retirement System, to the System.

Retirement for a Volunteer Firefighter

What if a volunteer firefighter wishes to retire after twenty (20) years of service?

The following must be submitted to the System:

- Application for Retirement (Form 1)

- Minutes from the local board where a local board exists

- Request for Federal and State Income Tax Withholding (Form 6)

How is a pension benefit for a volunteer firefighter calculated?

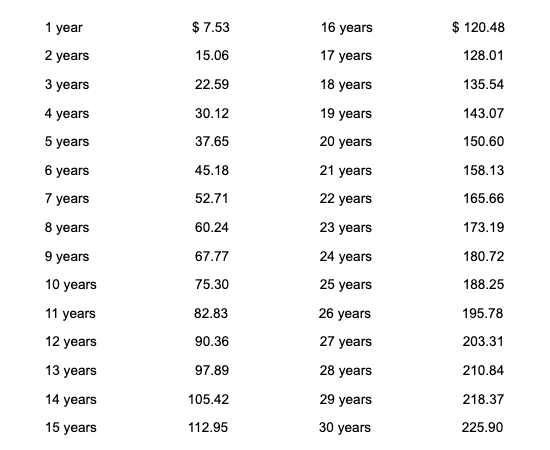

The monthly pension benefit for a volunteer firefighter shall be in the amount retired volunteers are receiving at the time the volunteer begins to receive a pension for each year of credited service not to exceed thirty (30) years. In determining the number of years of credited service, a fractional year of six (6) months or more shall be counted as one full year (as long as the firefighter has completed the initial twenty (20) years of service), and a fractional year of less than six (6) months shall not be counted in such determination.

Retired volunteer firefighters shall receive a pension of not less than that which retired volunteer firefighters were receiving on July 1, 2008. The amount of the volunteer firefighter pension is subject to change each year, so it is imperative that participating municipalities check with the state office to determine the volunteer benefit amount.

The majority of volunteer firefighters will receive a monthly pension benefit as indicated in the following schedule:

Disability Retirement for a Volunteer Firefighter

What if a volunteer firefighter wishes to apply for a disability in line of duty pension?

The following information must be submitted to the System:

- Application for Disability Pension (Form 2)

- Minutes from the local board where the local board exists

- Two (2) physician’s statements certifying the disability and that the applicant can no longer perform the duties of a firefighter.

- Proof of injury reports, if available

- Request for Federal and State Income Tax Withholding (Form 6)

How is a disability in line of duty pension calculated for a volunteer firefighter?

A volunteer firefighter who receives a disability in line of duty pension shall be paid the same amount as a twenty (20) year volunteer service pension unless the firefighter has more than twenty (20) years of credited service, at which time the service years as listed in Question 28 would apply.

What if a volunteer firefighter wishes to apply for a disability not in line of duty pension?

The following information must be submitted to the System:

- Application for Disability Pension (Form 2)

- Minutes of the local board where the local board exists

- Two physician’s statements certifying the disability and that the applicant can no longer perform the duties of a firefighter

- Request for Federal and State Income Tax Withholding (Form 6)

How is a disability not in line of duty pension calculated for a volunteer firefighter?

A volunteer firefighter who receives a disability not in line of duty pension will be paid $6.37 for each year the volunteer was a member of the participating municipality if the firefighter has served less than twenty (20) years.

Credited Service

What is credited service?

Credited service is the period of time used to determine the eligibility for retirement benefits to be received by the member. It shall consist of the period during which the member participated in the system or the predecessor municipal systems as an active employee in an eligible membership classification, plus any service prior to the establishment of the predecessor municipal systems which was credited under the predecessor municipal systems; provided however, “credited service” for members from a fire protection district shall not begin accruing before July 1, 1982.

Can a paid firefighter receive service credit accumulated while a member of another state retirement system?

A paid member may receive up to five (5) years of credited service accumulated while a member of the Oklahoma Police Pension and Retirement System, Oklahoma Law Enforcement Retirement System, Teacher’s Retirement System, or the Oklahoma Public Employee Retirement System. This credit of service applies only if the member is not receiving or eligible to receive retirement credit or benefits from these systems. The transferred service will be added after the member reaches a normal retirement date. To receive the service, credit contributions must be paid to the system. Contributions will be determined by the actuarial assumptions adopted by the State Board as provided in Title 11, ’49-117.3 of Oklahoma State Statute. The State Board may permit the member to pay the purchase price over a period not to exceed sixty (60) months through payroll deduction.

How does service in the armed forces affect a member's credited service?

Service in the armed forces is generally administered pursuant to Section 49-138 of Title 11 of the Oklahoma Statutes. As of February 5, 1997, the District Court of Oklahoma County allowed members who retired after June 29, 1981, to count up to five (5) years of military service towards a pension benefit calculation. See the questions under Military Service for a more thorough discussion.

Vested Benefit

What is a vested benefit?

A member who participates in the System is not entitled to a pension benefit unless the member has completed ten (10) years of credited service, except for an in line of duty disability benefit. A member with ten (10) or more years of credited service who terminates service with less than twenty (20) years of credited service may elect to apply for a vested benefit. A vested benefit entitles the member to receive a monthly retirement annuity, which would commence on the date the member reaches fifty (50) years of age or the date the member would have completed twenty (20) years of uninterrupted employment, whichever is later.

When may a member elect a vested benefit?

If the member has completed ten (10) years of credited service at the date of termination, the member may elect a vested benefit in lieu of a refund of the contributions paid by the member while an active firefighter. The five thousand dollar ($5,000.00) death benefit will not apply to a member who elects a vested benefit.

How is a vested benefit calculated?

A vested benefit for a paid member is calculated by using two and one-half percent (2.5%) of final average salary multiplied by the number of years of credited service. Example: if a member has served twelve (12) years and six (6) months at the time of termination, the member would be entitled to 31.25% of his final average salary at age fifty (50) or on the date the member would have completed twenty (20) years of service, whichever is later.

A vested benefit for a volunteer member is calculated by multiplying $ 6.37 for each year of service. Example: if a volunteer member has served fifteen (15) years at the time of termination, the member would be entitled to a vested benefit of $95.55 at age fifty (50) or on the date the member would have completed twenty (20) years of service, whichever is later. Remember, volunteer amounts may change each year, so you should contact the pension office to determine the amount a volunteer is eligible to receive.

What must be submitted to the System when a member elects a vested benefit?

- Application for Vested Benefit (Form 18)

- Minutes from the local board where a local board exists

- Copy of birth certificate